Taxation - Live and Online Course

Standalone or Part of Major Award

In this blended online module, the learner will learn taxation practices and principles, which will enable them to work in an administrative capacity in the taxation process, working independently or as a supervisor overseeing the work of others. This programme is also useful if the learner is looking to progress to higher education and training.

WANT TO KNOW MORE ABOUT THIS COURSE?

Check below for more details.

Single modules are the best way to build your path to becoming fully certified and

get recognised by NFQ education point scheme.

This course will be suitable for you, should you be new to your role or if you wish to gain this valuable qualification and find a job in this sector.

Access to the Programme

Mature Applicants with relevant life and work experience are welcomed. The Course Advisor is available to meet with prospective learners to discuss and advise on the course details, career and academic opportunities and assess your suitability for the course.

Entry Criteria

Entry criteria / prerequisites Level 4 Certificate / Leaving Certificate (or equivalent) or relevant life experience detailed in a current Curriculum Vitae. Please provide details and attach a copy of either a current CV or Certificate. Learners must be a resident of Ireland / based in Ireland.

English

As this NFQ level 5 qualification is delivered through English it is necessary learners will have sufficient written English skills to complete this course. Forus Training recommends a minimum English language competency of IELTS 5.5 (or equivalent) for successful completion of this programme. If you are not sure what level of English competency you have, please contact hello@forustraining.ie and a Course Advisor will arrange for you to take an assessment.

IT Skills and Equipment Required

Basic working knowledge of computers and access to a computer with internet access is required to do the course. A PC with Windows 8 or later or a Mac with OSX 10.5 or later.

- An internet connection with a speed of at least 10mbps.

- The latest version of Chrome, Firefox, Edge or Safari, set to accept cookies and pop-ups.

- Adobe Flash and Adobe Reader, to view content.

- Word processing software, such as MS Word or Google Docs.

- Some courses include video, therefore your computer must be capable of playing video and sound.

* eLearning and tutor support may vary by course, please check each course page for details.

Reasonable Accommodation

To reinforce inclusion for all our learners we offer customised learning support for individual applicants who require accommodations. Additional Requirements Forus Training provide a range of supports for learners to ensure that our programmes and services are accessible to all.

On application for a course with Forus Training please discuss any additional requirements with the Course Advisor at hello@forustraining.ie so that the appropriate supports for teaching, learning and assessment can be considered. It is important that you discuss your needs with centre staff as early as possible.

Through this programme you will discover how to;

- Explore the various trading structures through which a business can carry out its activities

- Identify the tax returns that a typical business is required to make including the tax records required for a Revenue audit

- Summarise the general concepts and procedures relating to Value Added Tax (VAT) to include thresholds for VAT registration, procedures for registration, the records required for accurate VAT accounting, VAT rates and the VAT implications of inter-EU trade

- Examine the Corporation tax and Capital Gains Tax obligations applicable to a range of business activities to include tax rates, payment dates and reliefs

- Analyse the tax rules applicable to dealing with contractors and sub-contractors, to include an explanation of which rules apply, the calculation of sub-contractor tax liability and the documentation required to complete tax returns relating to contractors

- Summarise the PAYE and PRSI system to include tax credits, standard rate cutoff points, different pay frequencies, the tax treatment of benefit-in-kind, expense claims, disability benefits and maternity payments

- Comment on the general operation of Pension Schemes to include the registration of new employees and the tax treatment of a range of additional pension contributions

- Explore the tax treatment of and procedures relating to a range of tax areas including Directors Loans, Redundancy Payments and Leases and Hire Purchase of assets

- Appraise the tax advantages and disadvantages of a range of business trading structures

- Access the Revenue¿s online tax payment facilities and apply for a range of tax certificates and forms

- Calculate a range of tax payments, reliefs and deductions

- Assist in preparing the Annual Tax Return

- Process the registration of new employees with Pension Schemes

- Contribute to the tax accounting for a range of payments, reliefs and deductions

- Prepare a range of monthly and annual tax returns.

WHAT WILL YOU DO ON THIS COURSE?

The Taxation - Live and Online course outline can be found below...

Content coming soon

FIND WHAT PEOPLE SAY ABOUT THIS COURSE.

All the reviews about Taxation - Live and Online course

Assessment

The course 5N1421 Taxation is assessed in the following ways, with the following weighting;

- Collection of Work 50%

- Examination 50%.

Collection of Work 50%

A portfolio or collection of work is a collection and/or selection of pieces of work produced by the learner over a period of time that demonstrates achievement of a range of learning outcomes. The collection may be self-generated or may be generated in response to a particular brief or tasks/activities devised by the assessor.

Examination 50%

An examination provides a means of assessing a learner's ability to recall and apply knowledge, skills and understanding within a set period of time and under clearly specified conditions. A theory-based examination assesses the ability to recall, apply and understand specific theory and knowledge.

Grading

Pass 50% - 64%

Merit 65% - 70%

Distinction 80% - 100%

Tutor Support

At Forus Training, we have many different supports available for your learning.

Learner Pack

- When you enrol on a course, you will receive a printed learner pack from your trainer on the first session of the event.

- This learner pack contains clear assessment instructions and comprehensive material to support you as you complete the course.

- The pack will also include induction information as well as forms that you will complete during and at the end of your course.

Trainer Support

- The trainer provides support to learners, including issuing feedback on draft work you will submit. Expect to wait up to 72 hours for a response by email from your trainer. Many of our trainers have full time jobs as well as training with us this means they will have up-to-date sector specific information, but also means that you need to allow a little time for them to get back to you. Our trainers are current with practice in the sector in which they work.

- Trainers can, by appointment, make time available to you before or after class to answer your queries that cannot be covered in the session. They can also make an appointment with you to discuss your work on a telephone call.

Assessment Upload Facility

- We have a user-friendly assessment upload facility available to you.

Support with Preparing for Assessment

If it has been a while since you’ve studied, we have free, short presentations on Study Skills, Academic Writing and Harvard Referencing to assist you in your work.

Technical Support

- Every Saturday, our Digital Ambassador Team holds a Zoom meeting – to assist learners with their technology related challenges - no question too small! The staff in this “Digital Ambassador“ role are experienced in accessing all of our systems, including the LMS and myforustraining.ie. They are positioned to assist with all the usual technology queries learners might have: Microsoft Office (Word, PowerPoint, Excel etc), email, file saving and organisation etc.

- Technical support is available by phone to 044 9349400 or by email: hello@forustraining.ie or through the contact form on our website.

Compassionate Consideration

- Where a Learner, pursuing an award, through no fault of his/her own, is unable to complete their assessment, the exit pathway below is in place to facilitate this Learner with an alternative course. The Learner is given the opportunity to obtain the Award by completing the course at an alternative date/location should they have relocated to an area where we provide the same award.

- The following are examples of circumstances where a Learner is unable to complete their project/their course:

● Bereavement,

● Illness,

● Pregnancy,

● Relocation,

● Extenuating circumstances.

- Please see P9 S7 C6 Compassionate Consideration Policy.

Learner Welfare

- P9 S6 C6 Learner Welfare Policy and practices are fully integrated throughout teaching and learning experiences by both Trainers and staff to effectively meet the health and wellbeing needs of all Learners. The Forus Training welfare policy is focused on the welfare of all Learners and addresses any particular challenges individual Learners may be experiencing during their learning experience. The learning environment includes welfare support provided by staff for Learners which is fully integrated throughout the teaching and learning and organisation of teaching and learning to effectively meet the personal, social (wellbeing) and academic needs of Learners and staff. Please see the policy here P9 S6 C6 Learner Welfare Policy.

Supports for Learners with Disabilities and Specific Learning Difficulties

- Forus Training is fully committed to complying with relevant policies and legislation with respect to equality and disability. Registered and potential Learners with verified disabilities or specific learning difficulties may be given compassionate consideration and reasonable accommodation to enable them to successfully complete their programme. This is arranged by the Course Coordinator.

- A reasonable accommodation is any action that helps to alleviate a substantial disadvantage due to an impairment or medical condition. Such accommodations are put in place to help reduce these barriers in order to provide equality of access and opportunity for all. Reasonable accommodations are made for Learners on a case by case basis and must be supported with medical documentation. Both P9 S2 C6 Evidence of Disability Form and P9 S2 C6A Application Form for Reasonable Accommodation can be found at the following link:

- https://forustraining.ie/knowledge-base/how-do-i-access-reasonable-accomodations/

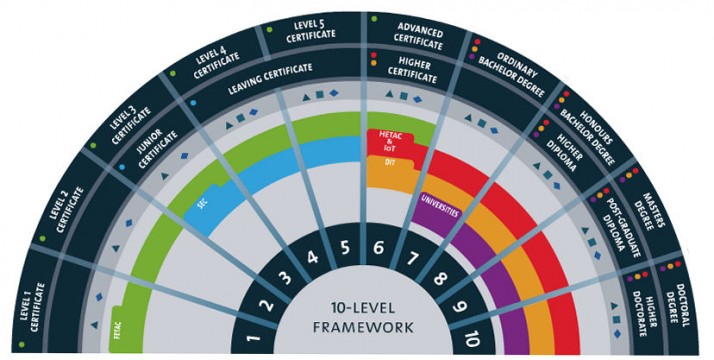

You will be awarded a certificate 5N1421 Taxation. QQI is the awarding body. Forus Training is a provider of education and training programmes and we issue certificates to learners who have reached the standard for a QQI award. The certificate you will receive on successful completion is a formal confirmation by QQI that you have demonstrated the knowledge, skill and competence required to achieve the named award. This Programme is validated by QQI and is coded 5N1421 Taxation. This certificate which will be issued to you by us is an award listed on the NFQ (National Framework of Qualifications). This ensures the certificate is nationally and internationally recognised and has many potential uses; for example, for further / higher education or employment in Ireland or abroad.

This course leads to a level 5 award on the National Framework of Qualifications. Students who successfully complete this programme may use their credits towards completing a higher level of study in the area of Business.

Students who successfully complete this Major Award can also use the Certificate as the basis for entry into selected courses in Third Level Colleges and Universities.

Click here to download a pdf version of – Progression from QQI Level 5 Certificates and Level 6 Advanced Certificates to Higher Education Courses 2017.

Registration can take place through our website, this will involve you completing the relevant application form, providing us with your personal information so we can complete the registration on our side. Registration can also take place by telephone/email/Whatsapp or in person, this will involve you providing us details of the course you wish to study, providing us your payment details and agreeing to proceed with the purchase. By completing registration, you are agreeing to the terms and conditions set out herein.

Please read Terms & Conditions here.

DO YOU WANT TO GET A COURSE BROCHURE?

In this blended online module, the learner will learn taxation practices and principles, which will enable them to work in an administrative capacity in the taxation process, working independently or as a supervisor overseeing the work of others. This programme is also useful if the learner is looking to progress to higher education and training.

What is QQI?

QQI is the state agency responsible for the external quality assurance of further and higher education and training in Ireland.

QQI are responsible for the external quality assurance of further and higher education and training in Ireland.

QQI validate programmes, make awards and are responsible for the promotion, maintenance, development and review of the National Framework of Qualifications (NFQ).

QQI also inform the public about the quality of education and training programmes and qualifications, and advise the Government on national policy regarding quality assurance and enhancement in education and training.